Building Models to Predict the Future

Welcome to a fresh edition of Growth Croissant! 🚀 🥐

I’m Reid, your host on this journey. I’ve been lucky to be part of awesome teams that launched and grew Hulu, Crunchyroll, and HBO Max. A few years ago, I founded Yem to help individuals and small teams build their own media businesses. Yem was acquired by Substack, where I currently work on growth.

Growth Croissant will be an evolving home for everything our teams have learned over the past 10+ years. My goal is to deliver you a comprehensive and actionable guidebook on how to grow your business.

Hello friends,

Compared to other business models, subscriptions are more predictable and easier to forecast, making it more straightforward to develop and execute growth plans. That said, we've seen many businesses build forecast models in a way that leads to significant inaccuracies, bad investments, and flawed goals. The most common mistake is using churn rate (instead of retention rates) to predict paid cancels, leading to wildly inaccurate forecasts.

But when done well, a reliable forecast of your subscription growth can provide the following benefits:

Provide baseline expectations for subscriber growth and revenue.

Encourage a forward-looking mindset by shifting focus from immediate cash earnings to long-term revenue.

Help set reliable goals (e.g., X paid subscribers by the end of the year) and allocate any investments (e.g., $X in marketing budget with a $Y customer acquisition cost, or establish plans to build your team).

Explore different growth scenarios to find the right balance of risk and reward.

Our friend Tony Mecia from The Charlotte Ledger ("TCL") has agreed to partner with us to walk through how to build a forecast model for a subscription business. TCL is a digital-first local news publication, providing original reporting and journalism to Charlotte-area residents. As of today, TCL has 2,450 paying subscribers. Here's a view of their paid subscription growth each quarter:

An important note before diving in: building a forecast model before there’s a consistent pattern of growth will most likely be inaccurate or not the best use of time. Earlier on, it’s usually best to focus on what problem you’re solving, who you’re solving that problem for, and trying to get those folks to use your product or service.

Ok, let’s build a forecast model to help us predict the future.

Forecasting new paid subscriptions

Two major assumptions go into a forecast model for subscription businesses:

The number of new paid subscribers joining over time.

The number of paid subscribers canceling over time.

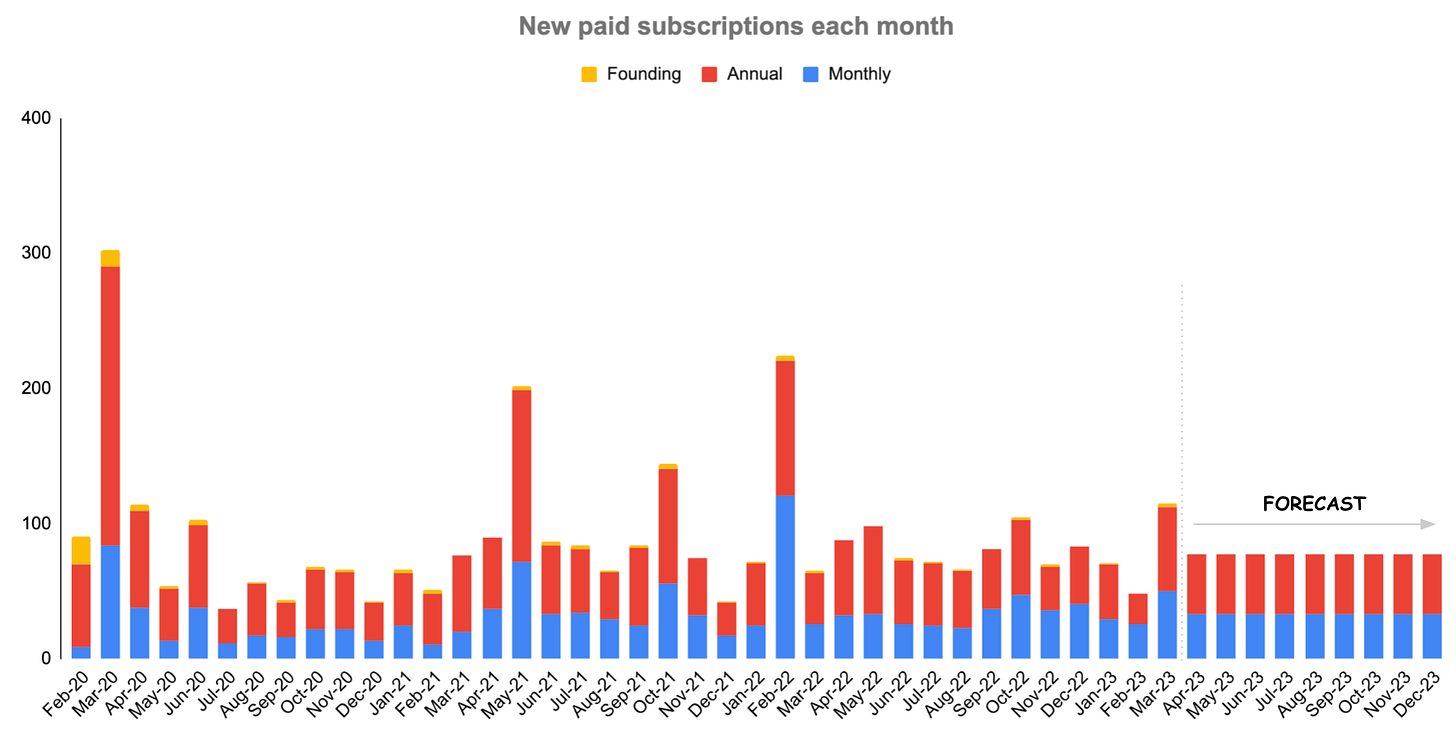

Let’s start with predicting new paid subscriptions. To get our bearings, let’s look at new paid subscriptions for The Charlotte Ledger each month, segmented by monthly, annual, and founding subscriptions:

Segmenting by monthly vs. annual renewals is necessary as we’ll want to forecast the two types of subscriptions separately. There’s the obvious difference: annual renewals only happen once per year, whereas monthly renewals occur 12 times per year. But also, annual subscriptions usually have far better retention than monthly subscriptions, which is essential to consider for our forecast.

To predict the future stream of new paid subscriptions, as a starting point, it can help to look at average new paid subscriptions in recent months, as well as growth rates on a month-over-month basis (“MoM”), and year-over-year basis (“YoY”). For TCL, having a long history of new paid subscription data is beneficial, giving us more confidence in our forecast. Over the past year or so, YoY growth in new paid subscriptions has hovered around +50%, while MoM growth has averaged +2.5%. Except for a few months of substantial growth in new paid subs, we see roughly 33 new monthly subs and 45 new annual subs each month. To keep our initial model conservative, let’s use these averages as our forecast for new paid subs for April through the rest of 2023.

TCL’s new paid subscriptions are pretty consistent, but we can still see moments of step-function growth. Our goal isn’t necessarily to precisely predict each month’s new paid subscriptions; we mostly want to get close to the average new paid subscriptions for the rest of the year. If we have initiatives coming up that we think can drive outsized growth — say, a marketing campaign, a major news story, or even a new team member — we could increase our forecast to reflect those efforts.

On the point of irregularity, a valuable byproduct of building a forecast is helping you identify moments of elevated renewals. For TCL, many renewals happen in February, March, and May. We can expect higher cash earnings during this period. But we should also expect more paid cancels, both from payment-related issues and subs reaching the end of their subscription after choosing to cancel. In some cases, it can make sense to adjust your plans around higher levels of renewals, attempting to make your product most compelling during these times to reduce churn.

Forecasting paid cancels

In a previous post, we covered how to use subscription data to build a subscriber decay curve to forecast customer lifetime value. We’ll use the same approach and subscriber decay curve to predict how cohorts of paid subs — existing and expected future subs — will cancel over time. The subscriber decay curve can be remarkably consistent over time, which makes it easier to predict customer lifetime value and subscriber growth. Forecasting paid cancels has a much lower margin of error than predicting the stream of new paid subscriptions.

The Charlotte Ledger has a few years of data on how well they retain paid subscribers, which we will use to form our assumptions for how well TCL will retain subscribers over time. Like our forecast for new paid subscriptions, we want different retention assumptions for monthly vs. annual subscribers to forecast subscription growth. Based on TCL’s retention data, here’s a view of our assumption for how TCL will retain monthly and annual subscribers over time (i.e., the subscriber decay curve):

You may notice that the decay curve stretches to five years. We need a long time horizon for our decay curve to predict the probability of canceling for all subscribers based on where they are in their subscription tenure, including those that have been paying for multiple years. TCL turned on paid subscriptions in February 2020, making that its longest-tenured cohort. For subs in the Feb ’20 cohort that are still around, to forecast their retention for the rest of 2023, we’ll need to predict what share of them will cancel in their 38th month, 39th month, all the way through their 47th month in December ’23.

Putting the puzzle together

We now have our two key assumptions squared away: new paid subscriptions coming in for the rest of the year and how well we’ll retain paid subscribers (existing and future subs) over time. We can then start to bring these pieces together, plotting monthly cohorts and the number of subscribers remaining over time. As a reminder, we’ll forecast monthly and annual subscriptions separately.

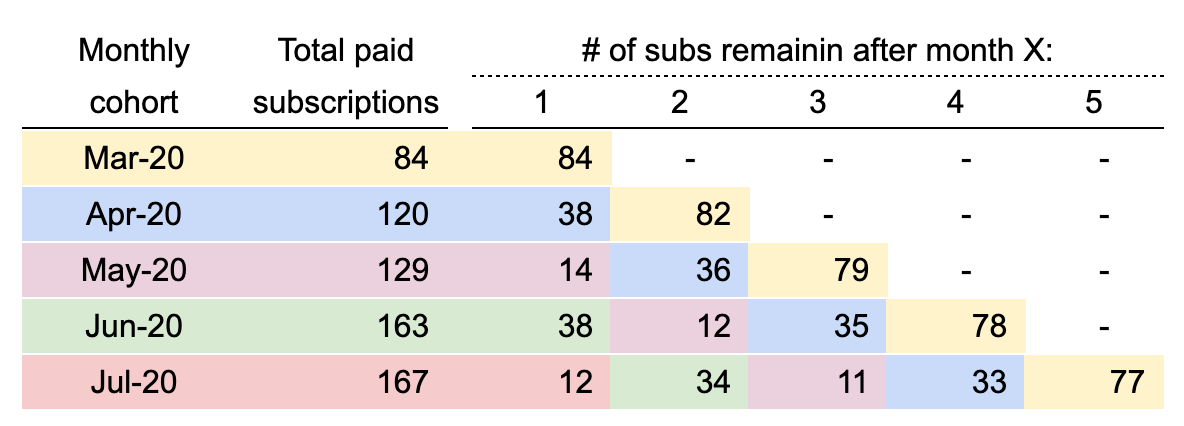

To give you a sense of what this looks like in the model, here’s a snapshot of a few early cohorts of monthly subscribers:

From the snapshot, we can track how a specific cohort churns over time. For example, let’s look at the March 2020 cohort highlighted in yellow above. We see 84 new paid subscriptions started in March ’20. We can then follow the stair-step progression to see what share of that cohort remains over time: 82 renewed into the second month, 79 renewed into the third month, and so on.

We can also track how each cohort contributes to total paid subscriptions over time, creating an ever-blossoming layer cake. For example, by the end of July 2020 (the bottom line shown above), there were 167 total paid subscriptions: 12 of which joined that month; 34 were in their second month from the June ’20 cohort; 11 were in their third month from the May ’20 cohort; and so on.

We can also look at how our forecast of new monthly paid subscriptions will retain over time. As a reminder, we’re assuming TCL will add 33 new monthly subscriptions each month for the rest of the year, driving a total of 297 new paid subscriptions. Combined with our decay curve assumption, of the 297 total monthly subscriptions, we expect to still have 220 monthly subscriptions by the end of the year.

To round out our forecast, we apply the same approach to all existing paid subscribers, predicting what share will stick around for the rest of the year. There’s no elegant way to show what this looks like, so let’s quickly glance at this eye chart below so you have an idea of the mechanics:

After we go through the same process with annual subscriptions1, we have our forecast of paid subscription growth for the rest of the year. The Charlotte Ledger can expect to add 450 net new paid subscriptions, ending the year with 2,900 paid subscriptions at a run rate of $310,000 in annual recurring revenue ("ARR").

We can also forecast our cash earnings based on expected retention and the timing of renewals, which can be quite helpful as we consider growth investments. Here’s a view of estimated cash earnings for the rest of the year:

Cone of possibilities

Now that we have our status quo plan, we can explore different growth scenarios. Let’s imagine The Charlotte Ledger is considering various growth efforts: ramping up the marketing budget; adding more team members; launching a new section; or starting a podcast). We probably have a rough idea of what these types of investments would cost. We can adjust our model to see what we would have to believe for these types of investments to make sense.

Let’s keep it simple and only adjust our assumption on new paid subscriptions. For a “Medium” case, let’s assume +15% year-over-year growth in new paid subs, which brings in an extra 137 net paid subscriptions, $14,000 in ARR, and $10,000 in net subscription revenue. For a “High” case, let’s aim for +35% YoY growth in new paid subs, adding an extra 436 net paid subscriptions, $45,000 in ARR, and $31,000 in net subscription revenue. Here’s a comparison of new paid subscriptions and paid cancels for the rest of the year across each scenario:

Here’s a summary of subscription growth, run rate of annual recurring revenue (ARR), and net subscription revenue across the different scenarios:

We can now gut-check investment opportunities against a few different growth cases. If we’re adding a new team member to launch a podcast or a new editorial section, we can gauge where we need to be to offset that cost. If we want to hire a part-time growth lead, we can set informed goals, ensuring they outperform our “status quo” plan.

Subscription businesses take time to build — for an investment to make sense, it doesn’t necessarily need to return all the cash right away (remember our discussion on CAC : CLV ratio). But having a view of your cash earnings over time will ensure you have the funds needed for any investments. Over time, you will build an intuition on the degree to which specific plans are feasible (e.g., “35% YoY growth in new paid subscriptions!? That’s hard!”), guiding you to better decisions on how to grow your business.

Summary

Forecast models were integral to our operations at Hulu, Crunchyroll, and HBO Max. We used these models to form annual budgets, which would dictate our company goals (with incentives tied to them) and budgets for marketing, content, headcount, and other items. We also used these forecast models for strategic decisions (e.g., price increases, team/company acquisitions) or when asking for tons of money to build new products. As part of our reporting process, we updated our forecast models every week to evaluate performance and longer-term subscriber expectations. Even with pretty simple models, we consistently operated within 1% of our forecast one month out and were usually within 10% accuracy for annual budgets.

In a similar way, having a reliable forecast model as you build your business may help set expectations for subscriber growth, cash earnings, and weigh different strategic decisions. If you would like a template of the forecast model, let me know by replying to the email or in the comments.

I know I always say “I’d love to hear from you” or ask questions at the end, but it really does make my day when folks comment or reply over email. So, I’d love to hear from you — what parts were useful and what parts were confusing? Did any of it resonate with you? What ideas did this spark for your business?

A big thank you to Tony for continuing to partner with us on these posts — we very much appreciate it.

Thanks for reading,

Reid

And founding subscriptions if it’s a meaningful enough portion of subscribers.

If some forecasting was built into the dashboard, I think you'd see lower churn of newsletter creators in the first and second year. They need to be able to visualize what their creativity could become. I may be wrong but my impression is there is a blind spot.

The majority of newsletter writers don't seem to take a long-term view of what paid subscriptions. Plus sponsored ads with flat fees can become in terms of a side gig.

If Substack did what Paved does, and took 15% instead of 30%. What a different business model this would all be for you and us.

Yea that approach makes a ton of sense essentially applying a % of the total. Yea makes sense, especially as you said, with the retention behaviours being similar. Thanks a ton! Excited to read the rest of the articles on your page