How To Avoid Wasting Money On Paid Ads

Measuring and optimizing our investment in paid ads

Hello friends,

Welcome to part 2 of our miniseries on using our customer lifetime value (“CLV”) model to invest in paid ads. In part 1, we partnered with Tony Mecia, the founder of The Charlotte Ledger (“TCL”), to create a CLV model and use it to set a goal for how much we can invest to add new subscribers (i.e., customer acquisition cost, or “CAC”). Tony has graciously agreed to partner with us for part 2, where we’ll cover how to measure the performance of our ads and explore a few ways to optimize spend.

For anyone who has recently joined us, we’ve created an index of all our posts on customer lifetime value, which we'll keep updated along the way.

Okay, let’s get to it!

Are we hitting our CAC target?

Over the past few years, The Charlotte Ledger has invested ~$22,000 into ads on Facebook across various campaigns. TCL usually runs paid ads on an ad-hoc basis (vs. an always-on marketing channel). The goal of these ads ranged from driving clicks, landing page views, and new paid subscribers.

But most of TCL's investment went toward driving new free subscribers. Here are a few high-level metrics for all the campaigns aimed at driving new free subs:

$13,552 total ad spend

3,609 new free subscribers

$3.76 cost per new free subscriber

Great news: the cost per new free subscriber is roughly in line with the $3 CAC target we set in our last post. Now let's further unpack performance to understand the quality of these new free subscribers.

What's the quality of these subscribers?

For this step, let’s focus on an ad campaign that ran during the first week of the year — this allows a little time for new subs to unsubscribe, engage with recent posts, and upgrade to paid subscriptions. The total ad spend for the campaign was $328, driving 92 new free subscribers at a cost per new sub of $3.57.1 Here are a few of the ads:

The first order of business is to check how many new free subscribers have upgraded to a paid subscription. Just over one month out, we haven’t seen any free subs convert to paid (yet). We can compare that to all the non-paid-ads subs that signed up in the same period, where 3.4% have converted to paid.2

In all our paid ads experiments at Substack and Yem, while hitting our CAC for free subs was usually attainable, free-to-paid conversion was elusive. If you try investing in paid ads, pay close attention to how many free subs upgrade to paid subscriptions.

Also, don’t expect all the paid-ads subs to upgrade right away. Unlike subs signing up organically, subs coming in via paid ads will likely need more time and effort to convert to paid. Keep an eye on conversion over time (30 days is a good check-in point, but keep track after that as well). Sometimes, it may even make sense to put extra effort into onboarding these subs, working hard to ensure they understand your product and value proposition (especially the additional value they get as a paid sub).

Beyond conversion to paid, we also want to keep an eye on engagement, which can give us a sense of the likelihood of converting to paid at a later date. Also, if you monetize outside of subscriptions (e.g., sponsorships, events, merch, 1:1 consultations), engaged subs can still drive revenue.

For TCL, the good news is that subs coming in through paid ads have roughly the same engagement as subs outside of paid ads, including lifetime open rate (47% for paid-ads subs vs. 50% for all other subs) and average opens per unique email open (1.7 for paid-ads subs vs. 1.6 for other subs). Looking at the extremes, we see roughly the same share of subs that have opened every email (13% for paid-ads subs vs. 11% for all other subs) and that have never opened an email (12% for paid-ads subs vs. 13% for all other subs). Here’s a table summarizing a few key engagement metrics for the paid ads subs vs. all other subs:

How to optimize?

Now that we have data on how our ads are doing, let’s explore how we could improve performance and get more bang for our buck. Let's stay focused on Facebook ads, but try to avoid getting too tactical. There are far more knowledgeable people on the internet when it comes to Facebook ads. But more importantly, tactics can be fleeting — I'm hoping to give you persistent frameworks you can use, no matter what ad platform or marketing channel is trending or best suits your needs.

There are usually a few key optimization levers with paid ads:

Audience targeting (e.g., using your email list to build lookalike audiences; using engagement & payment data to create a score within your custom audience)

Ad creative (e.g., image vs. video; formal vs. informal; 4x5 vs. 9x16 dimensions)

Landing page (e.g, driving traffic to a page with only essential info vs. about page vs. a post or article)

Before diving into each one, a few best practices to note. Early on, it’s usually best to allow for bid optimization at the campaign level to allow Facebook (or other ad platforms) to allocate spend toward the most compelling audience, ad creative, and landing page. Also, to make sure we have enough spend to get reliable insights, it’s usually best to start with a daily budget that is at least 10x your CAC target. If we have a $5 CAC target, our initial daily budget should be at least $50.

Audience targeting

For audience targeting, we usually begin with this process:

We upload the email list to Facebook to create a custom audience.

We also upload existing subscribers to avoid targeting them with our ads.3

Sometimes we upload a "value score" based on engagement and payment data.

We use the custom audience from above to create a few target audiences:

"Core" lookalike (<1%) — a smaller group of potential subscribers that most closely resemble the current audience.

"Prospect" lookalike (1% - 10%) — still based on the custom audience but a larger, more expansive group than the core lookalike.

General audience — do very little (if any) filtering and let Facebook work its magic.

Compared to other businesses, given The Charlotte Ledger focuses on local news, their audience is in a relatively tight geographic area. As such, geo-targeting is quite effective for TCL. They have also had success combining geo-targeting with interest-based targeting (e.g., The New York Times, The Wall Street Journal, current events, crosswords, local news).

After our ads have been live for a week or so (sometimes longer), we can nudge spend toward lower-CAC, higher-CLV4 audiences. We can also use the Facebook pixel (or any other ad platform's pixel) to set up re-targeting ads. For example, you could target ads toward people that visit your website or fall out of the subscribe flow.

Ad creative

At the outset, we usually like to have a core image and video ad. For the video ad, it’s ideal to have a ~15-second ad, but also nice to have a 6-second and 30-second version. For image and video ads, it can help to have variations tailored to 1x1, 4x5, and 9x16 dimensions. Developing ad creative can be time-consuming — it’s totally okay to start with a simple 4x5 image ad and go from there.

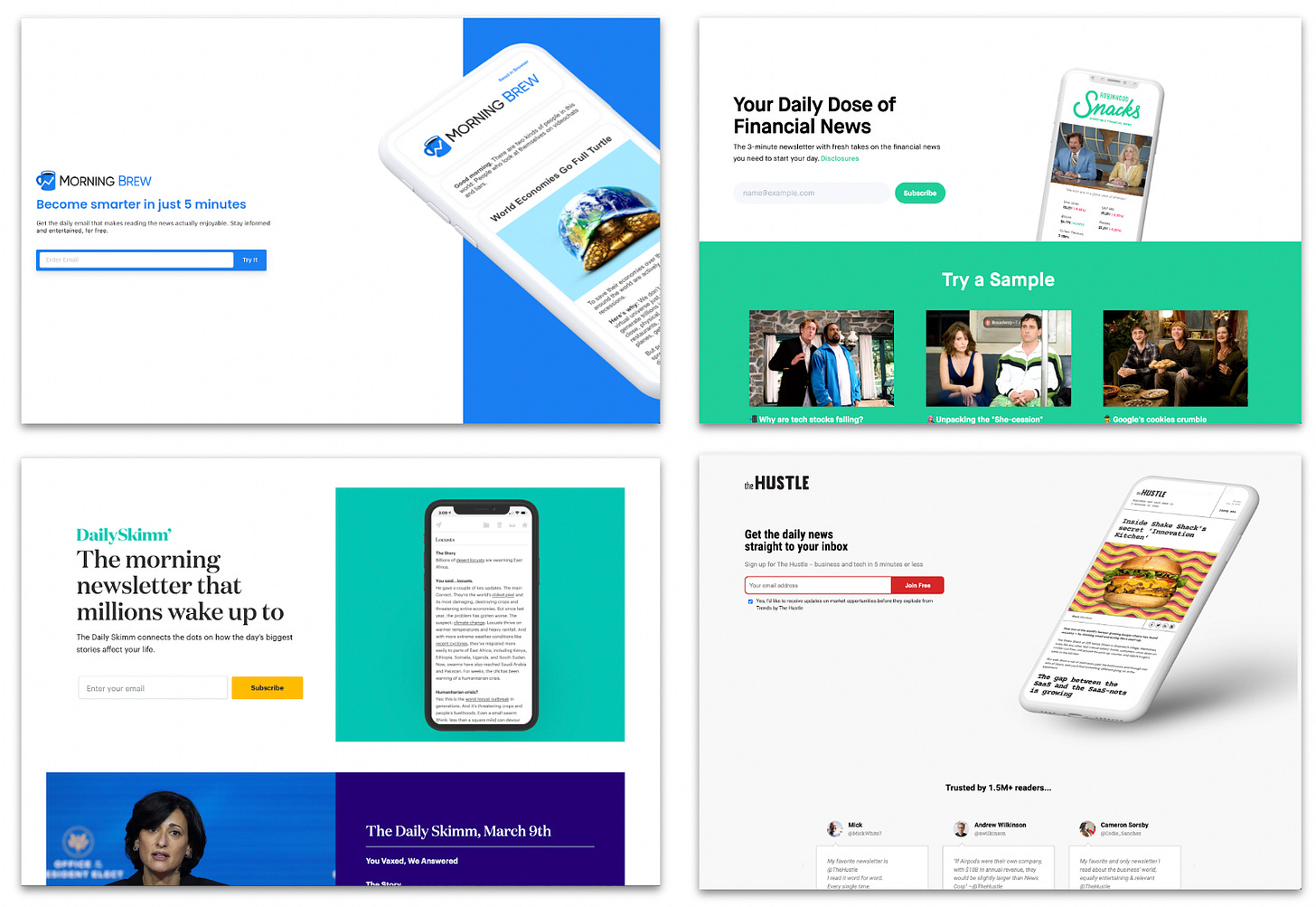

To spark ideas for ad creative, you can check out what ads similar businesses are running in Facebook's Ad Library. For TCL, we could check out active ads for other news businesses (e.g., The New York Times, The Wall Street Journal) or other newsletter-centric businesses (e.g., Morning Brew, theSkimm, Axios, The Information).

Once our ads have been in the wild, we can check the CAC based on where our ads are showing up (e.g., Facebook vs. Instagram; Feed vs. Stories vs. Reels). For TCL, since we're only running a 4x5 & 1x1 image ad, most of our spend is funneling toward the Feed on Facebook and Instagram. While these ads are doing pretty well, we could explore ways to shift some spend to Stories and Reels, which are more vertical-oriented (e.g., we could try out a 9x16 image ad) and are more video-centric (e.g., we could mix in a 5- to 15-second video ad).

Landing page

Have you ever noticed that a lot of landing pages look similar? Shown below are landing pages for some of the largest newsletter businesses.5 These have probably been tested into a unified set of best practices: showing the product and conveying only the essential info needed to get someone to use your product and making sure there’s a clear call-to-action (e.g., account creation or subscribing).

Some audiences may need more context or info about your product before handing over their email. In those cases, ads might perform better when directing traffic to a landing page that describes your product, your value proposition, and why someone would need it (e.g., About pages on Substack).

There are also scenarios where sending traffic to a specific part of your product can make sense. For HBO Max, perhaps it’s running Game of Thrones ads and driving people to watch the first episode. For TCL, they’ve run ads for popular posts (e.g., getting a lot of views, shares, and likes), directing traffic straight to the full post.

One thing to keep in mind — if you’re using anything other than a concise landing page, make sure you still make it easy for folks to take the action you want (e.g., including a few “Subscribe” call-to-actions in your About page or full post).

One last option to callout: lead-generation ads that allow people to subscribe without having to leave the Facebook experience.

There are some risks with lead-gen ads. Landing pages help prospective customers better understand your product, which usually improves the quality of folks that sign up; lead-gen ads aren’t able to convey as much info to ensure quality leads. Also, since lead-gen ads keep folks in the Facebook experience, new subscribers don’t get to interact with your product right away, including checking out some of your top posts or having the option to upgrade to a paid subscription.

That said, lead-gen ads can make it much easier for folks to subscribe, driving down your CAC. Depending on your setup, lead-gen ads can also help with attribution (you can download the emails of everyone that subscribed via the ad).

We now know how to measure our investment in paid ads and whether we're lighting cash on fire. Assuming it's a reasonably sound investment, we also know how to optimize our spend once we have sufficient data.

Another round of applause for Tony 👏👏 — thank you for partnering with us on the last two posts. Also a big shoutout to Jay Rockman, who taught me everything I know about buying ads on Facebook, TikTok, and other marketing platforms.

As always, let me know what you think by replying to this email or dropping a comment below.

Thank you for reading,

Reid

These numbers are quite small, so would advise against taking any concrete conclusions away from the metrics. We’re only using this ad campaign to walk through the process of measuring performance and optimizing our investment.

Again, the numbers are quite small here. If we had just 3 of the paid-ads subs upgrade to paid, our conversion rate would be the same as non-paid-ads subs (3 paid / 86 total = 3.5% conversion rate). As we’ll note later, some of these free subs haven’t really experienced the product yet or even seen the upgrade-to-paid flow, so it may take a little more time for these subs to convert to paid.

On the other hand, we can also target existing free subscribers with ads aimed at encouraging them to upgrade to paid, including special offers or discounts.

We won’t have a reliable view on CLV right after a sub signs up, but can lean on engagement metrics to gauge subscriber quality.

The same is true of landing pages for streaming video services, B2B SaaS, meal delivery apps, etc.

This was so helpful. Thanks again!

What can be added?

1. The problem for all subscription businesses, as in your example, is the very low subscription price, as a result, you need to be able to keep a subscriber for a large number of payment periods in order to get a unit the economy is positive.

2. Thus, a lot of effort goes into optimizing conversions and lowering the cost of a lead, but the worst thing is that we find ourselves in a very competitive segment, where a lot of businesses compete for cheap traffic, and as a result, the price of traffic is systematically growing.

3. However, if we raise the price, and focus on LTV, the price of traffic is still important, but not so critical. If, for example, the monthly price of a subscription is $10, and the average LTV is $70, then with the price of a free subscriber, I assume that the average CAC will be about $25-40. This is still good, but critical, since getting a subscriber to pay regularly is difficult, and the development resource is very small.

4. If the subscription price is $50, for example, then the average LTV can jump to $300 or $500, so even if the customer's price goes up to $70-100, it doesn't matter and the economy gets much stronger.

5. This approach raises a different question - what subscription levels to add to increase their monthly price to 50, 100, 500 or 1000$? There are quite a few such cases.

6. This approach, in particular, is widely used in the gaming industry, in the f2p model, which is many times more efficient from an economic point of view than any media business. In such games, the share of paying players is usually no higher than 3%, however, LTV can reach hundreds of thousands of dollars.