Welcome to a fresh Growth Croissant! 🚀 🥐

I’m Reid, your host on this journey. I’ve been lucky to be part of incredible teams that launched and grew notable consumer subscription products: Hulu, Crunchyroll, HBO Max, and Substack.

Growth Croissant will be an evolving home for our learnings, painful lessons, and frameworks for making hard decisions. My goal is to deliver you a comprehensive and actionable guidebook on how to grow your business.

Hello friends,

Welcome back to our ongoing series on better retaining your paying subscribers — one of the best ways to drive sustainable improvements to customer lifetime value (“CLV”) and long-term revenue growth.

Here are the topics we’ve covered so far on how to improve retention:

Growth tactics to retain folks that are on the fence about canceling.

Better onboarding to connect new subscribers with your value proposition.

Using audience surveys to identify your core audience and how to 10x the degree to which you solve their problem.

Community-strengthening features (e.g., status, inside jokes) to encourage loyalty.

Healthy habit-forming features (e.g., goals, streaks) to help folks reach their goals through your product.

It may not be the most electric topic, but I’d be remiss if we had a retention series without mentioning payment failures and how they impact cancels. From our first retention post:

It’s also essential to segment by the two primary flavors of paid cancels:

Voluntary cancels — when the subscriber chooses to cancel their subscription.

Involuntary cancels — when the subscriber’s subscription ends due to a payment-related issue (i.e., the subscriber doesn’t necessarily choose to cancel).

Most businesses are surprised to find that involuntary cancels can represent between 25% to 50% of their total cancels. At any point, roughly 5% of your paying subscribers may be “past due” — they’re going through the credit card retry process after a payment failure and are at risk of canceling. (If you use Stripe Connect, you can see all your past-due subscriptions by clicking here.)

With involuntary cancels, the subscriber hasn’t chosen to cancel. Compared to voluntary cancels, involuntary cancels disproportionately impact your most valuable subscribers that would have stayed subscribed for a long time or forever.

Payment-related cancels are such a big issue that a few sizable businesses have emerged to solve this problem (e.g., Recurly, Chargify, Zuora). Luckily, the major payment processors (e.g., Stripe, Adyen) are adding these value-added services and features, making it less necessary to use another tool.

But as a subscription business grows, so does the opportunity to improve retention by reducing involuntary cancels. While working on voluntary cancels centers on guiding folks away from choosing to cancel, reducing involuntary cancels is primarily about letting subscribers know there’s an issue and making improvements to your payments infrastructure. Let’s explore a few ways to reduce payment issues and improve retention.

Disclaimer: if you’re just getting started, you shouldn’t worry about any of this stuff. Also, similar to our habit-forming post, this post may lean a bit toward product managers or larger consumer subscription products.

What are payment failures?

Online payments can fail for a variety of reasons. Usually, a payment processor will provide insight into the decline reason. Sometimes it’s due to straightforward issues, like an expired credit card (“54: Expired card”), or there’s not enough money in a person’s account (“51: Insufficient funds”), or the customer’s bank suspects the charge is fraudulent (“59: Suspected fraud”).

Other times, the reason the payment fails can be a bit opaque, including the familiar “05: Do not honor” decline reason, which acts like a catchall for a range of reasons a charge doesn’t go through. Often, these failures can come from a lack of trust between the issuing bank (which represents the consumer) and the acquiring bank (which represents the merchant or business). Payment failures from a lack of trust between banks happen much more frequently for international, cross-border transactions.1

Stripe provides the image below to show a representative share of charge declines by decline code. It maps close to what we’ve seen — “insufficient funds” were usually 35% to 50% of our declines, while “do not honor” would account for 25% to 35%.2

After the initial payment failure, nearly every payment platform will help you retry the credit card.3 The image below shows the basic retry schedule that is part of Stripe Connect.

Stripe’s Smart Retries feature uses machine learning and a bunch of payment data to choose the best time to retry a failed payment. Smart Retries is a great example of Stripe adding features aimed at lowering involuntary cancels, though it’s only available as part of the higher-priced Scale tier.4

If you’re not retrying cards after a payment failure, you should absolutely start retrying cards as a first step in lowering involuntary cancels. Even a limited retry schedule like the one offered by Stripe Connect will save a lot of subscribers from canceling.

Notifying subscribers

In the streaming world, we tried various things to chip away at payment-related cancels — nothing had more of an impact than simply letting subscribers know their payment failed and giving them an easy way to update their payment info.

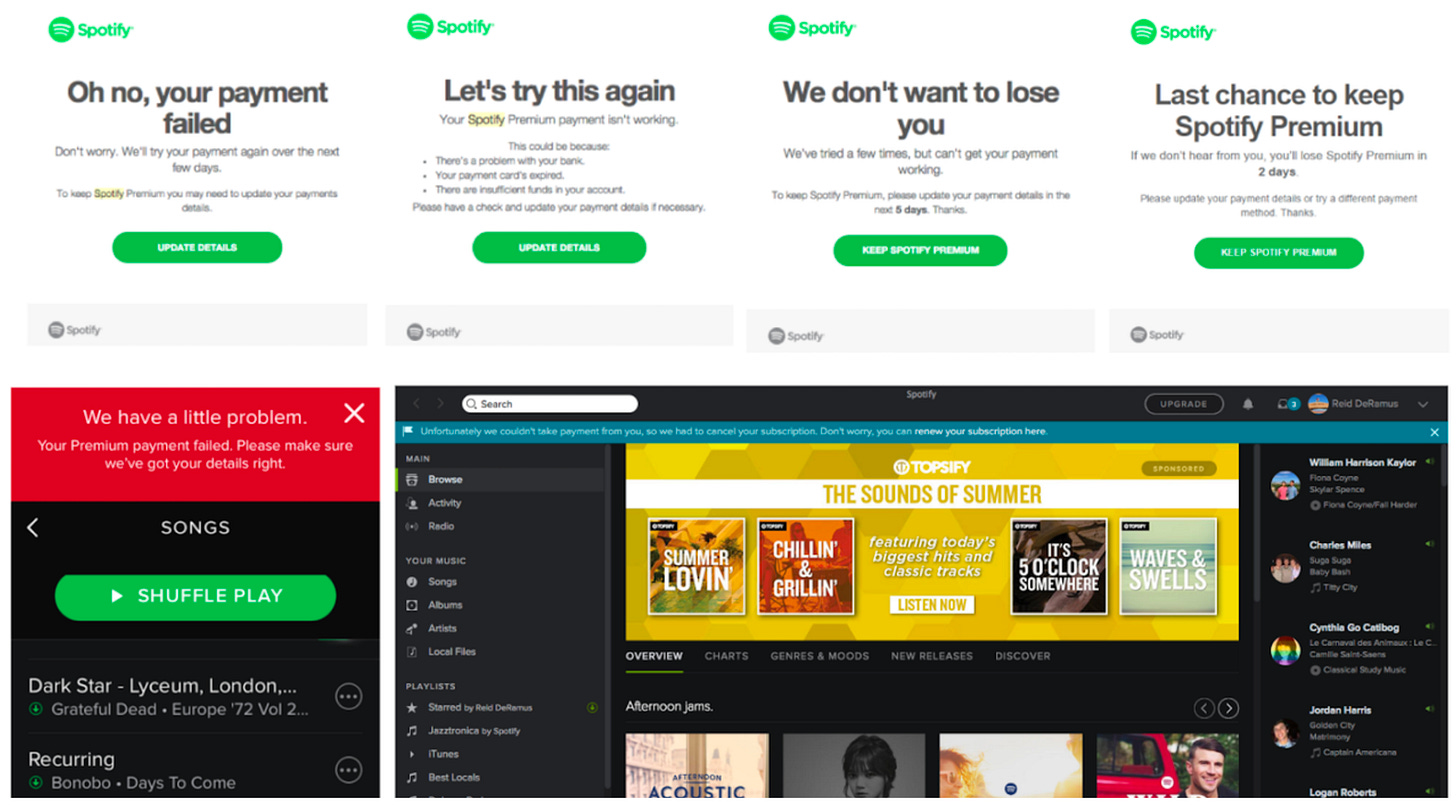

Below is a (fairly dated) example of automated payment failure messaging from Spotify:

Some things Spotify does well in its payment failure notifications:

Unifying comms across each touchpoint, including email, the mobile app, and the desktop app.

Balancing a firm nudge to update the payment info (i.e., four dedicated emails) without becoming spammy.

Making minor tweaks in their messaging to avoid sending the same email repeatedly.

Adding a sense of urgency by reminding the recipient how close they are to losing access in the last week.

At Substack, we send similar messages to encourage subscribers to update their payment info, helping save a significant portion of subs that experience a payment failure. We also have a few tactics aimed at preventing payment failures. For example, when a subscriber approaches their renewal date with an expired credit card, we send an email and dashboard notification asking them to update their payment information (especially helpful for annual subscriptions).

Other ways to reduce payment failures

For most earlier-stage subscription businesses, a basic retry schedule and messaging subscribers will be all you need in fighting involuntary churn. For larger subscription businesses, here are a few other tactics and features that may be worth considering:

Storing multiple payment methods — allowing subscribers to have multiple payment methods so there’s a backup card on file in case the primary one fails.

Using account updater — card networks provide updated credit card information so that merchants can always access up-to-date credit card details for their subscribers.

Optimizing retry schedule — there’s a world of optimization opportunities around retrying cards after a payment failure, like adjusting the retry schedule based on the decline reason, the subscriber's location/region, and the issuing bank.

Adjusting the “grace period” — most subscription services will give subscribers the benefit of the doubt and allow them to keep their paid benefits after a charge failure. We tried shorter grace periods, where subscribers would lose access seven days after their payment failed, but we would keep retrying their card for the next few weeks. The shorter grace period can create urgency for folks to update their payment info.

Routing payments to different processors — some processors will outperform in certain regions or types of payments. At scale, a business can route each transaction toward the processor with the highest expected value (e.g., higher authorization rate, lower payment fees, etc.).

Enabling wallet-based payment options — for many wallet-based payment methods (e.g., Android & iOS in-app billing, PayPal), when a payment fails, the subscriber needs only to update their payment info in one place. As such, subscribers using a wallet-based payment method can retain better than those using a credit card. (That said, the impact on retention is only a small slice of evaluating wallet-based payment methods.5)

Summary

Involuntary cancels can act as a forceful headwind to paid subscription growth. While payment failures are inevitable, it’s possible to chip away at this problem, driving noticeable improvements to retention and boosting customer lifetime value.

For any subscription business, make sure to retry cards after a failed payment and let subscribers know they need to update their payment method. These two things alone will capture most of the value in reducing involuntary cancels.

As a subscription business grows, its investment in preventing payment-related cancels can ramp up. To give a sense of the promised land, the largest consumer subscription services (e.g., Netflix, Spotify) have teams of folks focused on A/B testing retry schedules, different communication strategies, and routing transactions to different processors, all on a segmented basis (e.g., decline reason, country/region, type of payment method).

Let me know what you think. Were you surprised to find involuntary cancels can represent such a large portion of total cancels? Any tips or learnings to share with others on how to lower payment failures?

As always, thanks for reading,

Reid

Robin Gandhi has an excellent post on the relationship between issuing and acquiring banks, and how local acquiring can help reduce payment failures.

Compared to Hulu, Crunchyroll had many more payment failures and involuntary cancels. Part of this was due to the audience makeup — Crunchyroll’s subscribers were generally younger and had less disposable income than Hulu subscribers (i.e., more “insufficient funds” declines). We also had more subscribers outside the U.S. and tried to process a larger volume of cross-border transactions, so we ran into many of the intra-bank trust issues mentioned above (i.e., a lot more “do not honor” declines). These dynamics will impact how much of a problem and opportunity payment failures are for your business.

Hard declines — like “expired card”, “invalid card”, or “invalid transaction” — should not be retried. Your hope here is that you get updated card info via Account Updater or the subscriber updating their payment info. Then you can retry the updated payment info in an attempt to save that subscriber from canceling.

As Stripe and other payment platforms get better at offering their own tools to reduce payment failures, it’s likely those features will only be available as part of higher-priced tiers. For larger businesses, it could be a worthwhile investment.

It’s also important to consider:

The benefit of reducing friction on driving new subscribers.

The higher fees associated with wallet-based payments.

The cost of building and maintaining the new wallet-based payment method.

Any strategic implications. (e.g., How does ownership of the billing relationship impact any future plans?)

This is super useful Reid. Thanks. I’m curious about how these tips are being used in an ‘automated’ way by Substack to help us noobs on here who just want to focus on the publishing. Or are there options for us individually to improve things?

Good stuff, Reid. I've run a martial arts gym for almost 20 years now, and this is spot on. Retention is huge in any subscription business! The longer you operate, the more important it becomes as a KPI.