The Most Important Metric for Any Business

How to use CLV to unlock the full potential of your business

Thank you for signing up and joining this adventure.

Over the last decade, I've been fortunate to be a part of outstanding teams that helped launch and grow Hulu, Crunchyroll, HBO Max, and now Substack. All these services have amassed millions of paid subscribers, but we've made plenty of mistakes along the way and learned a lot about growing consumer subscription businesses.

When talking with other entrepreneurs, operators, and investors, we found ourselves covering the same learnings and decision-making frameworks to help them avoid all the common mistakes and pitfalls. I'm excited to write about our experience and hope Growth Croissant will become a comprehensive guide to help you grow your business.

In all our conversations, one topic always comes up — the single most important metric for any subscription business: customer lifetime value ("CLV"). The first few posts will cover the nuts and bolts of CLV, how to calculate it, and how to avoid fooling yourself.

One metric to rule them all

For businesses, there are two ways to make more money:

Grow the number of customers.

Increase the value of those customers.

While certainly not easy to do, growing customers is easy to grasp and track. Determining the value of your customers is more nuanced. At the heart of it is a single, all-encompassing metric: customer lifetime value.

CLV is often misunderstood or, like most buzzwords, known nominally. The first few posts of Growth Croissant will define and unpack CLV to drive us toward a deeper understanding. We'll use this as a foundation to explore impactful decisions like the following:

What's the right approach to pricing?

How do I differentiate my free tier vs. paid tier?

How do I build a budget and set goals for my product?

What's the right level of investment in growth for my product? When, if ever, should I start to build out a team?

Let's start with a high-level definition. We'll then explore the primary CLV drivers and their relationship with each other. Then, we'll build a CLV model for a hypothetical product to drive it all home.

A brief aside: the initial posts will focus on consumer subscription products. Many businesses will have wider distribution and more than one revenue stream. To introduce CLV, we'll focus on subscriptions first. Future posts will discuss how to add new products and revenue streams (which may be more transactional) to boost CLV.

Definition of customer lifetime value

With customer lifetime value, we want to know how much money we can expect to make when someone starts using your product.

Now the textbook version: CLV is the cumulative contribution profit earned during a customer's relationship with our product. I know, a mouthful — let's start to unpack it.

Cumulative Contribution Profit

Contribution profit is revenue minus your variable costs.

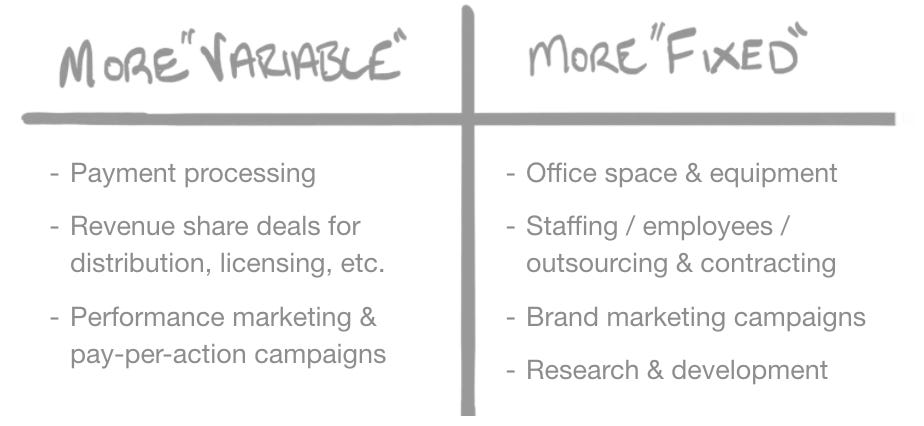

Compared to fixed costs, variable costs usually increase as you make more money. Variable costs can be easy to identify when they have a direct relationship with revenue growth, like Apple's app store revenue share (15% - 30%) or Stripe's payment fees (0.30¢ + 2.9% for each successful payment). Other costs can have a close, but not necessarily direct, relationship with revenue.

The line between variable and fixed costs can be blurry. We can sidestep most of the complexity for now — the key is to avoid using revenue when thinking about CLV. Using revenue is one of the most common mistakes we see when determining CLV.

We use contribution profit to make sure we're making money on a per-customer basis. If we're losing money on each customer, our business won’t be around long. As we add more customers (which is usually hard to do), we're amplifying how much money we're losing. If we refrain from factoring in our variable costs and only use revenue, we can easily fool ourselves into thinking we're doing a great job.

Customer Lifetime

"Customer lifetime" is an estimate of how many times a customer will buy your product over time. For subscription products, we want to know how long someone will remain a paying subscriber before they cancel.

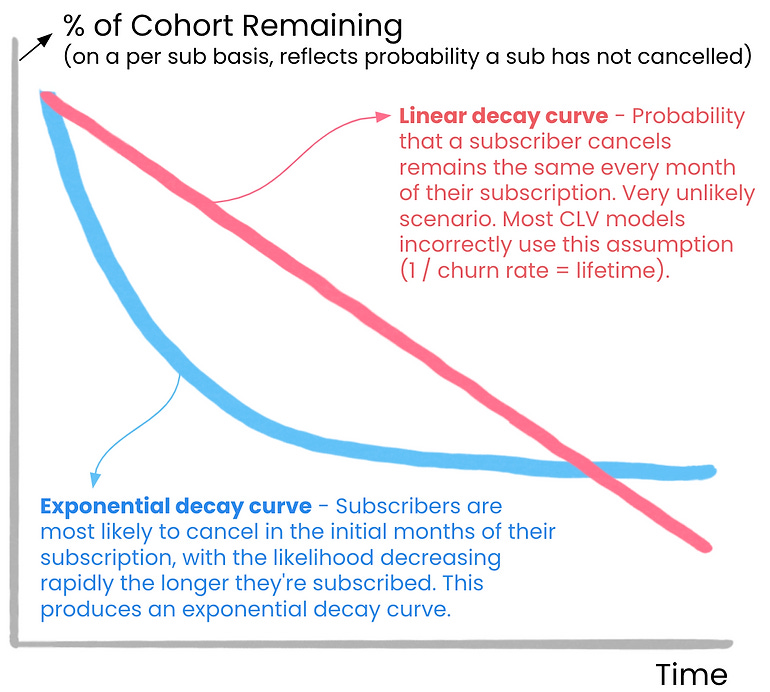

Usually, subscribers are most likely to cancel earlier in their subscription. And the likelihood of canceling decreases rapidly the longer someone stays subscribed. As an example, after their first payment, based on billing data we have for existing customers, we could predict the following:

20% chance they will cancel in their 1st month

10% chance they will cancel in their 2nd month

3.5% chance they will cancel in their 6th month

0.75% chance they will cancel in their 12th month

In other words, the probability that a paying subscriber will cancel decreases exponentially, not linearly, over time. We can use these cancel rates to produce a customer decay curve. The curve shows the likelihood that someone remains subscribed over time.

"Customer lifetime" is usually expressed as a number (e.g., 24 months), but it's really just shorthand for the shape of the customer decay curve. As we will see, the shape is far more meaningful than the calculated number.

We must obsess over better retaining our paying subscribers and extending customer lifetime — it's usually the most enduring growth lever and can signal how much we're improving our product over time. Improving retention can be challenging, especially as we try to expand our audience and grow our paying subscribers, which almost always acts as a headwind to extending customer lifetime. CLV models can help combat this dynamic by pinpointing how to deliver more value to your subscribers.

A few things to keep in mind

It's crucial to recognize that CLV is a projection, a prediction of the future — it's not factual and shouldn't be considered scripture. When we build your CLV model, know that it shows future earnings and can be far from accurate or guaranteed. You should always feel a bit uneasy about using CLV to make decisions, but that's okay — it's better than flipping a coin or taking a stab in the dark. CLV models were ingrained into our daily operations as we grew Hulu, Crunchyroll, and HBO Max by millions of subscribers.

Most of our early discussions will cover average customer lifetime value, which can be helpful with a few strategic decisions. But beyond that, we quickly dance into the danger of using averages. CLV becomes most actionable and valuable as we segment our audience, which we will return to at some point.

A closing thought: when we talk to founders, entrepreneurs, and operators, they usually just want to know the number — "what's my CLV?!". If there's one thing you take away from this post, let it be this: calculating your CLV and knowing the number doesn't matter nearly as much as understanding CLV as a concept. As we deepen our understanding of CLV, we’ll have a sharper intuition and better mental models for making decisions. We'll be able to sift through the noise and focus on what truly matters to drive growth.

In our next post, we'll focus on unpacking the core drivers of CLV and, more importantly, exploring the relationship between those core drivers. Check it out:

Great insights on metrics.

This is exactly the type of content I was looking for. Thanks, Reid!

P.S. The name "Growth Croissant" is genius. (If anyone's wondering, look up what "croissance" means in french)