Boosting Retention with Better Onboarding

Hello friends,

Welcome to a new edition of Growth Croissant, a guidebook on growing subscription businesses.

The post below will continue our multi-part series on improving retention — one of the most meaningful levers we have to grow revenue. Keeping subscribers around longer is the best way to increase customer lifetime value (“CLV”). By extension, the stuff you do to improve retention usually makes your product better, making it more compelling to potential customers.

So improving retention is massively important, but how do we do it?

In part 1, we covered the difference between voluntary cancels (subscriber chooses to cancel) and involuntary cancels (subscriber cancels after payment-related issues), as well as some growth tactics that can chip away at voluntary cancels. Now let’s explore the harder-to-do, less-measurable tactics that prevent churn before subscribers even consider canceling.

Our goal isn’t to have zero people canceling paid subscriptions. If cancellations are too low, it could be a sign that we’re not being aggressive enough on audience growth and user acquisition. When a product has much better retention rates than its peers, we’ll sometimes give entrepreneurs or operators the feedback that their “health metrics are too good,” encouraging them to push the envelope on growth.

Some voluntary churn is natural and unavoidable — some folks who cancel during a free trial period or in their first month may not be your core audience. One theme that will emerge in our series: to improve retention, it’s usually best to focus on delivering more value to your core audience and avoid over-rotating toward fixing problems for more peripheral audiences.

Delivering more value doesn’t always mean launching new features, adding services, or offering more stuff. Sometimes, it’s about better connecting your subscribers with the value they seek from your product, which is especially important when onboarding new subscribers.

Let’s explore how we can strengthen retention by improving the new user experience and onboarding messaging.

Identifying valuable vs. risky behavior

A decade ago, not too long after Hulu Plus launched, we experienced a tsunami of cancellations. We hadn’t experienced any significant churn before, so there were a lot of burning questions from the higher-ups about what was going on. We didn’t have the tools or frameworks to confidently answer why people were canceling or the degree to which retention was an issue.

We were at least aware that most folks canceled early on. There was a massive drop-off during their 7-day free trial: 35% of trial subs would not convert to paid subscribers. For trialists who converted, another 20% didn’t make it to the second month. But after the first paid month, retention was quite strong. During a subscriber’s first month, it was crucial to onboard them effectively and connect them with the value of our product. But what exactly did that mean, and what messages should we prioritize during onboarding?

We started a project to compare the behavior of subscribers that canceled their free trial against those that converted to paid, and then the behavior of those that only paid once against those that made it past the first payment. Our goal was to identify behavior correlated with converting to paid after a trial and making it through the first billing period. We would then run tests to see if we could shape the new user experience and onboarding messaging to maximize conversion.

Many of our findings were intuitive. We discovered inactive users were much less likely to convert to paid subscriptions. We also noticed all types of engagement correlated with a higher likelihood of converting to paid subscriptions, including:

Depth — watching multiple episodes or several movies.

Variety — watching different genres or categories of series (e.g., satire/news like The Daily Show; adult animation like Family Guy; and drama series like Grey’s Anatomy).

Frequency — several sessions within a day or watching every day of the week.

Cross-platform — watching across multiple devices (e.g., mobile apps, set-top box / gaming consoles, desktop).

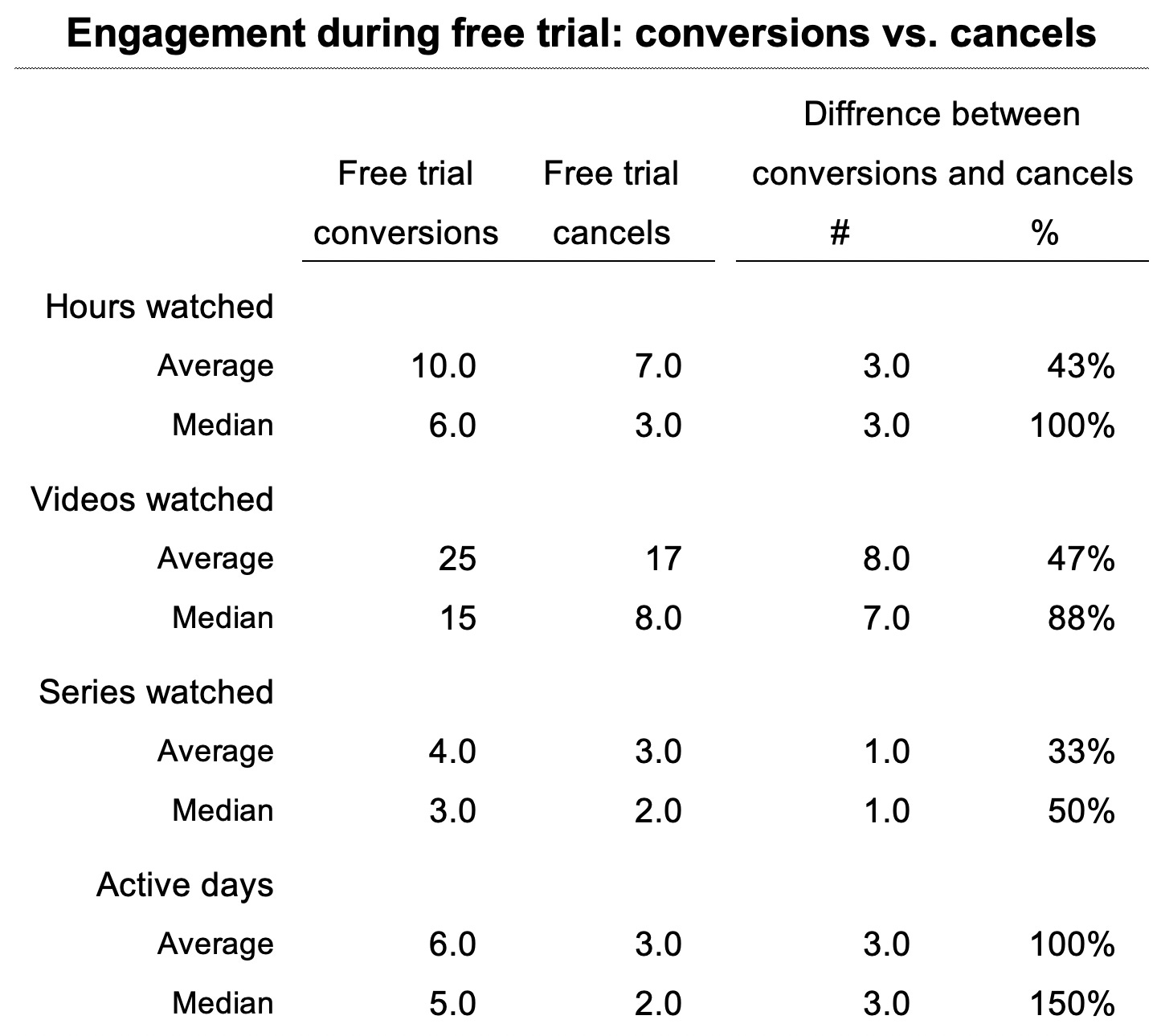

We only looked at engagement during the free trial period and segmented subscribers to control for other impactful dynamics. For example, unlike subs that convert to pay, trial subs that cancel on the first day don’t use the product for seven days. Here’s an example of what the summary output would look like with dummy data.

Onboarding new subscribers

The tricky part is that it’s challenging to elevate all these engagement metrics simultaneously, especially when onboarding a new subscriber. People don’t like reading instruction manuals or needing to take several actions to use your product. We want to avoid bombarding new folks with tons of emails/notifications, tooltips, and calls to action.

Where our analysis proved especially valuable was understanding what specific actions we should try to encourage early on. We could then run tests focused on elevating metrics related to those actions — hours watched for depth, series watched for variety, and days using the app for frequency — as part of onboarding new users in the product and through a series of emails and notifications.

For example, to drive more depth, we could highlight deep-catalog shows with multiple seasons in our onboarding messaging, in their personalized home feed, or in “Up Next” at the end of another stream. Here’s an example of HBO Max’s welcome email and initial home feed, which spotlight Friends (78 hours of content), Game of Thrones (70 hours), and The Big Bang Theory (140 hours!).

If we wanted to dial up frequency of usage, we could highlight short-form clips that folks could watch throughout the day. Here’s an example from Hulu Plus using higher-frequency notifications that feature clips from Saturday Night Live and news programs.

In the early days of Hulu, it was novel to stream video on your phone or on your TV. Subscribers that watched on “living room” devices (e.g., Apple TV, Roku, Xbox) had more engagement and a higher likelihood to convert to paid. Below are a few examples of onboarding emails aimed at getting subs to watch across different devices.

It was also useful to discover the relationship between these different types of engagement. It was risky if a subscriber had a lot of variety (e.g., multiple series watched) and low depth (e.g., low hours watched) — these folks were looking for something to watch and having a hard time finding something they liked.

On the flip side, depth without variety was also risky — these were usually folks coming in to watch a particular series and then cancel; what would eventually become known as “binge-watching”. Both these engagement patterns led to higher cancellation rates and shared a similar root problem of limited content availability or ineffective discovery/personalization.

Over time, we made onboarding flows more dynamic and reactive to each subscriber’s engagement. If a subscriber were only watching on their desktop computer, we would prioritize the device activation notifications. If they were only binge-watching deep-catalog series, we would highlight series that were premiering new episodes.

We continuously improved the trial conversion rate by experimenting with in-product onboarding and lifecycle messaging. Crucially, better onboarding also had a positive impact on long-term retention, boosting customer lifetime value. These improvements didn’t require us to buy more content or radically change the product — we just did a better job connecting each subscriber to the value they wanted from our product.

Rinse and repeat

Our team would go on to rinse and repeat this type of exercise at Crunchyroll and HBO Max (aka “Max”), using it to guide new user experience and onboarding messaging. We even used this framework as the basis for forming an onboarding series for paid newsletters at Yem.

For the paid newsletters we worked with, roughly 25% of new subscribers didn’t engage at all during their first month. Further, out of all paid subscriptions, 60% to 70% converted during their first month. We knew the first 30 days after signup was a critical period to get new subs engaged, aware of the value of a paid subscription, and surface timely prompts to upgrade to paid.

It may be a bit of an eye chart, but here’s an example of the onboarding emails for The Charlotte Ledger (“TCL”):

And here’s a table with more detail on the goal of these emails and when they were sent:

We didn’t do too much testing or optimization, or make the messaging dynamic based on a subscriber’s engagement. But even these basic onboarding emails helped lift free-to-paid conversion and reduce early dormancy for Yem’s customers.

For a more sophisticated approach to onboarding, here’s a recent post from Anjali Iyer, Head of Lifecycle Marketing at The Washington Post. Anjali shares examples of how The Post guides new subscribers through a series of “tailored messages based on their individual actions.” Their new subscriber journey has led to a “2% lift in retention and an increase in three-year CLV after 12 weeks”, which I imagine is quite valuable across WaPo’s large subscriber base.

Focusing on preventable churn

Let’s briefly detour back to our initial analysis at Hulu for a final point. When we dug into the folks canceling trials, we uncovered a large group of subscribers that were canceling right away. These “quick-cancels” fell into a few main categories:

Subs coming in via low-quality marketing channels, like affiliate marketing (e.g., TrialPay, Tapjoy). These subs usually had no interest in Hulu Plus but got rewarded for signing up for a trial (e.g., earning five carrots for Farmville). Not surprisingly, conversion to paid was substantially worse than other growth channels.

Subs searching for a title and canceling after realizing we didn’t have it. We eventually made it much easier to peruse our library before becoming a subscriber.

Subs that watched one video and canceling right after an ad break. Usually, these subs expected Hulu Plus to be ad-free and would cancel once they found out there were still ads.

It was helpful to understand why we saw such a large group of subs canceling right away, and we were able to make a few tweaks to reduce quick cancels. But ultimately, these subscribers weren’t part of our target audience at the time — no matter what we did, we were unlikely to keep these folks around. We were able to drive much more revenue growth by improving retention for our core subscribers.

Summary

One of the best ways to improve retention is better onboarding (in-product and messaging) for new subscribers. A good starting point is identifying behavior that tends to lead to better retention, then trying to encourage that behavior through onboarding. It’s imperative to prioritize and sequence the right calls to action, avoiding information overload and irrelevant messages (a surefire way to erode retention). With a solid foundation, you can get into a rhythm of continuous improvement by making onboarding messages dynamic and personalized based on each subscriber’s behavior.

If you’re looking for inspiration, Really Good Emails has examples of welcome and onboarding emails. For in-product tooltips, user flows, and messaging, check out UXArchive, UserOnboard, and GoodUX.

That’s all we got for this week — let us know what you think! Any insights or best practices to share around onboarding new subscribers? Any ideas on how you could improve onboarding for your product?

As always, thank you for reading,

Reid

Thanks for sharing these insights, Reid. Does substack provide analytics on free trials? I have noticed several new subscribers start with a free trial, but don’t have any visibility on how many are converting to full paid after the 7-day trial period ends.

Thank you, as always, and keep 'em coming! :)